When this blog started in April 2017 my goal were as follow:

"My

short term goal is to have my mortgage paid off in 3 years (~$160 000

left). My next goal is to have a net worth of $1 million by the age of

40, and my long term goal is to generate sufficient passive income

($15,000/month)."

I have recently revisited my goal to be more bold and more daring after being inspired by reading several books. I have decided to change my medium term goal to having a net worth of $10,000,000 by age 45. I am currently 29, so this will give me 16 years to reach that goal. I do not know right now how I'll achieve this goal but I am sure I'll figure out a way.

11/15/2018

11/12/2018

FIRE and finding your why.

Recently I have learned what the acronym FIRE means when it comes to personal finance: It stands for Financial Independence Retire Early, which is pretty much what I am trying to achieve through the goals that I have committed myself to. Some people will argue that retiring early can make life boring, but for me retiring just means that I have time to do the things that I really want to do.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

11/04/2018

Neighbor Joe - Passive Income November 2018 - $1,704/Year

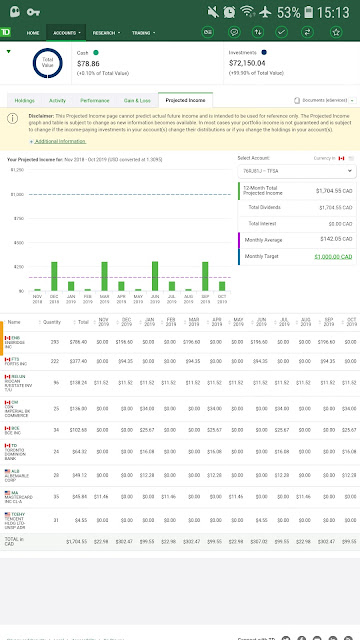

About a year ago I started to track my passive income as another way to track my progress. I like tracking passive income because it shows me an instant result of my investment. My brokerage account with TD has a very useful feature that shows the projected income for the next 12 months as shown in the screenshot below.

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

Neighbour Joe - November 2018 Net Worth

My apology for my disappearance in the last six months, but it has been a busy time with work and I lost focus on this blog. But now I am back and hope to be more active with my post. Here is my net worth as of today.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

Subscribe to:

Posts (Atom)