When this blog started in April 2017 my goal were as follow:

"My

short term goal is to have my mortgage paid off in 3 years (~$160 000

left). My next goal is to have a net worth of $1 million by the age of

40, and my long term goal is to generate sufficient passive income

($15,000/month)."

I have recently revisited my goal to be more bold and more daring after being inspired by reading several books. I have decided to change my medium term goal to having a net worth of $10,000,000 by age 45. I am currently 29, so this will give me 16 years to reach that goal. I do not know right now how I'll achieve this goal but I am sure I'll figure out a way.

11/15/2018

11/12/2018

FIRE and finding your why.

Recently I have learned what the acronym FIRE means when it comes to personal finance: It stands for Financial Independence Retire Early, which is pretty much what I am trying to achieve through the goals that I have committed myself to. Some people will argue that retiring early can make life boring, but for me retiring just means that I have time to do the things that I really want to do.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

11/04/2018

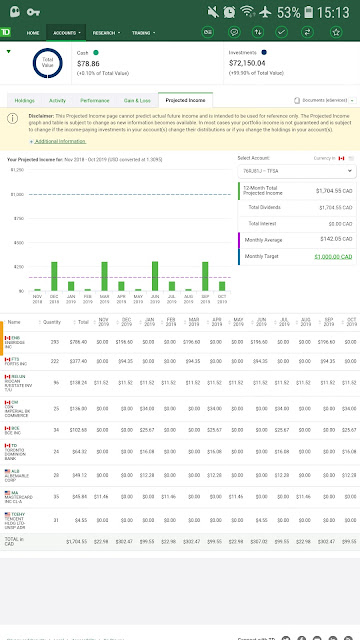

Neighbor Joe - Passive Income November 2018 - $1,704/Year

About a year ago I started to track my passive income as another way to track my progress. I like tracking passive income because it shows me an instant result of my investment. My brokerage account with TD has a very useful feature that shows the projected income for the next 12 months as shown in the screenshot below.

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

Neighbour Joe - November 2018 Net Worth

My apology for my disappearance in the last six months, but it has been a busy time with work and I lost focus on this blog. But now I am back and hope to be more active with my post. Here is my net worth as of today.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

3/16/2018

Time, the ultimate currency!

Today, I am going to try to put things in a new perspective and hopefully will either motivate you to start your journey or re-motivate you to keep going. The topic is that everything about this journey is related to time.

In 2011 there was a movie call "In Time" staring Justin Timberlake, which is enough for some people to go see the movie. I watched the movie because I was drawn into the concept presented in the movie where the universal currency became the time you have left to live. There is some truth to the movie, because currency is ultimately related to time.

You spend time to build your knowledge and skills which then translate to either getting a job or running your own business. Both of those will consume more of your time but you get money in return for your time. Therefore this can be written out in a simple formula: Time x Skills/Knowledge = Money. There is an old saying that time is money, but lets flip that saying, so money is time.

In 2011 there was a movie call "In Time" staring Justin Timberlake, which is enough for some people to go see the movie. I watched the movie because I was drawn into the concept presented in the movie where the universal currency became the time you have left to live. There is some truth to the movie, because currency is ultimately related to time.

You spend time to build your knowledge and skills which then translate to either getting a job or running your own business. Both of those will consume more of your time but you get money in return for your time. Therefore this can be written out in a simple formula: Time x Skills/Knowledge = Money. There is an old saying that time is money, but lets flip that saying, so money is time.

3/01/2018

Neighbour Joe - March 2018 Net Worth

The last update for FY 17/18.

Asset

Chequing: 218.43

TFSA Investment: $62,214.83

TFSA Mutual Fund: $3,814.04 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $132,501.36

*Credit Card is paid in full every month

Asset

Chequing: 218.43

TFSA Investment: $62,214.83

TFSA Mutual Fund: $3,814.04 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $132,501.36

*Credit Card is paid in full every month

2/19/2018

Neighbour Joe - February 2018 - $1,577.33/Year Passive Income

All, here is the latest update of my passive income. I have recently purchased more shares of Enbridge since the price has been dropping making it a attractive buy. The row with the green highlights indiciates that those are in USD. The total amount is show in CAD here. I used a 1.25 exchange rate for my calculation. I've also added a column to show much return I am currently getting from my book value of my investment. For those that don't know, the book value is the amount that was actually invested and will not change with market price. Have a nice winter day.

2/10/2018

Market is performing poorly, what should you do?

For those that have been following the market lately, you'll know that this past week it dropped significantly. All major index in North America were seeing double-digit percentage drop, Warren Buffet's net worth dropped by 11 billion dollars as a result.

So if you are looking at investing or have invested what should you do. The answer is don't panic and keep investing. Here is a quote from the guy who just lost 11 billion dollars.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”― Warren Buffett

The best time to purchase anything is when there is a sale or discount. Therefore whenever a market-wide correction happens all business will be affected, even those that are operating very efficiently. If you just look around you'll be able to see a lot of solid big cap company being sold at a bargain right now. Big Canadian Blue Chip such as Fortis, Enbridge, Bell are all selling at a discount right now. My advice will be don't invest all at once, spread your investment out since you don't know if it'll go higher or lower. By Investing at a consistent and regular interval you'll be less affected by market volatility.

2/09/2018

Poor man's Asset vs Wealthy Mindset Asset

If you know anything about accounting then its probably that Asset - Liability = Equity or Net Worth. In our monthly update here at Slowly But Wealthy we use this equation to calculate our net worth. However, what different from traditional accounting is that we choose to omit certain items in our assets category. For example, both Thirty Salaryman and I do not include our automobile in our asset.

This not because we are too lazy to do a straight line depreciation for our automobile. The main reason is we want to highlight that certain items are not what I'll call "wealthy mindset" assets. In this post, I wrote last year I talked about a similar topic. Here I want to expand on that topic.

Definition:

"An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a company's balance sheet, and they are bought or created to increase the value of a firm or benefit the firm's operations. An asset can be thought of as something that in the future can generate cash flow, reduce expenses, improve sales, regardless of whether it's a company's manufacturing equipment or a patent on a particular technology." - https://www.investopedia.com/terms/a/asset.asp

This is actually a pretty good definition of assets, pay attention to some keywords, "future benefit" and "generate cash flow". From a personal finance perspective, those two are key when you are trying to understand assets.

Poor man's Asset vs Wealthy Mindset Asset

I have personally further subcategorized asset into these two categories. Wealthy mindset assets are things that either provide future benefits or generate cash flow. Poor man's assets are things that don't. From a wealthy building perspective, benefits are defined as things that will increase your wealth. Therefore, if something will increase your wealth down the road then it's a wealthy mindset asset.

Let's talk about Poor man's asset first. Simply put, most of the "stuff" we "want" will fall into this category. Stuff like the latest iPhone or brand name fashion items will fall into this category. Some will argue that most wealthy people spend a lot of money in this category, that's true but in a relative scale, this is usually a very small portion of their asset. Another argument that I often hear is that you need to look wealthy to be wealthy, my response to that is no, you need to be wealthy to be able to look wealthy. These assets do not appreciate over time or generate cash flow and usually depreciate rapidly.

Wealthy mindest assets are things like equity in a big company, rental property or anything that will generate wealth. The key for this category is that it has to "generate positive wealth gains", so if you have assets that are not generating any value then it will not be in this category.

Summary

The key is to have more wealthy mindset assets in comparison to your poor man assets. You want to start using assets to generate more wealthy instead of just trading your time for money. The accumulation of good wealthy mindset assets is the key to becoming financially free.

2/01/2018

Neighbour Joe - February 2018 Net Worth

As we enter the month of love, here is my latest net worth update.

Asset

Chequing: 2407.63

TFSA Investment: $61,344.23

TFSA Mutual Fund: $3,872.25 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $135,126.07

*Credit Card is paid in full every month

January Net Worth: $303,480.88

Current Net Worth: $309,498.04 (+1.98%)

I have recently realized that during my monthly net worth update I am giving a false impression that all my gains are soley based on my investment. Just want to clarify that my monthly paycheque greatly contributes to my gains every month. Have a good February!

Asset

Chequing: 2407.63

TFSA Investment: $61,344.23

TFSA Mutual Fund: $3,872.25 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $135,126.07

*Credit Card is paid in full every month

January Net Worth: $303,480.88

Current Net Worth: $309,498.04 (+1.98%)

I have recently realized that during my monthly net worth update I am giving a false impression that all my gains are soley based on my investment. Just want to clarify that my monthly paycheque greatly contributes to my gains every month. Have a good February!

1/05/2018

DRIP - Getting wealthy at an exponential rate

Intro

Today I am going to talk about DRIP and how it can help you grow your wealth at an exponential rate. First of all, DRIP has nothing to do with water nor is it a metaphor for investing. DRIP stands for Dividend Reinvestment Plan and that is exactly what it is. DRIP is way for you to reinvest your dividends, usually back into the same equity that distributed the dividends.

Dividends for those that don't know are cash that a company pays its stockholder base on the number of shares you hold. If you read my passive income post you'll see that company like Enbridge (TSX: ENB) pays $0.671 per share on a quarterly basis. I hold 189 shares of Enbridge stocks and therefore I get pay around $127 on a quarterly basis.

How DRIP work is that instead of paying you the dividend ($127 from Enbridge) it will reinvest it for you by buying more shares. In my case, instead of getting $127 I get 2 whole share of Enbridge since they are trading around $50 per share right now and what ever cash remaining.

|

| A screenshot from my investment account showing how DRIP works. Enbridge recently increased it's dividend payout, therefore this picture don't match the numbers above. |

To set it up, you simply contact your investment broker and tell them that you want to setup a DRIP and they'll get you started. Just remember that for most cases, the dividend payout must be enough to purchase one whole share of the stock.

Benefits

There are a few benefits for setting up a DRIP. The first benefits is you don't have to pay any commission for the shares you purchase.

The second benefits is DRIP allows you to grow your investment at exponential rate by compounding. Then depending on the frequency of dividends payout you'll be compounding either monthly, quarterly or annually. Most people heard of compound interest and also learned it in school. This is the same thing, instead you are compounding your dividends. Below is a graph that shows the benefits of compounding and the different frequency of compounding.

Here is a quick calculator I found that helps you calculate the return on compound dividends. Calculator. Start investing and start DRIPing, let the power of compound work for you.

1/02/2018

Neighbour Joe - January 2018 Net Worth

Happy New Year. Although this month is the beginning of a new calendar year it is not

the end of the fiscal year therefore I won't be doing a year end summary till April.

As we entered into 2018, the first thing I did was make a lump sum payment into my mortgage with money that I have set aside. Here is my net worth as of today and the current breakdown.

Asset

Chequing: 433.41

TFSA Investment: $57,333.46

TFSA Mutual Fund: $3,840.08 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $135,126.07

*Credit Card is paid in full every month

December Net Worth: $300,758.74

Current Net Worth $303,480.88 (+0.9%)

Like a few net worth updates in 2017, the reason for my increase this months beside my usual salary income is from my investment portfolio. I re-consolidated all my marijuana investment and put it all into Canopy Growth (TSX: WEED). In the the last two weeks of 2017 the stock price jumped 48% giving me a unrealized gain of $3,540. I sold some of my holdings and realized about $350 gain on the last trading day of 2017. Hope all of you had a good holiday season and may all your financial goal be met in 2018.

As we entered into 2018, the first thing I did was make a lump sum payment into my mortgage with money that I have set aside. Here is my net worth as of today and the current breakdown.

Asset

Chequing: 433.41

TFSA Investment: $57,333.46

TFSA Mutual Fund: $3,840.08 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $135,126.07

*Credit Card is paid in full every month

December Net Worth: $300,758.74

Current Net Worth $303,480.88 (+0.9%)

Like a few net worth updates in 2017, the reason for my increase this months beside my usual salary income is from my investment portfolio. I re-consolidated all my marijuana investment and put it all into Canopy Growth (TSX: WEED). In the the last two weeks of 2017 the stock price jumped 48% giving me a unrealized gain of $3,540. I sold some of my holdings and realized about $350 gain on the last trading day of 2017. Hope all of you had a good holiday season and may all your financial goal be met in 2018.

Subscribe to:

Posts (Atom)