Here is my latest and greatest net-worth update.

Asset

Chequing: $1,669

TFSA Investment: $78,528 (Market Value)

RESP:$1050 (Market Value)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $122,113

*Credit Card is paid in full every month

Last Net Worth Update: $330,549

Current Net Worth: $336,139

A year ago, I posted my net worth updates, my net worth at that time was $309,498.04. Therefore in a year, I was able to increase my net worth by $26,641 which translate to about an 8% increases. Not a significant increase but still an increase regardless.

2/04/2019

1/28/2019

2019 Financial Goal

|

| Picture from my trip to Mt Kilimanjaro in 2015 |

While we are on the topic of goal setting, there is an acronym that you can use for goal setting. SMART, it stands for: Specific, Measurable, Achievable, Realistic, and Timely. Another way you can approach goal setting is just with the five simple W's. It's been proven that a lot of new year resolutions fail because people are just not good at setting goals. If your goal is to invest more this year then specify how much more, this way you have a measurable end result.

1/21/2019

7 Steps to Getting Rich!

I recently did a 13-hour road trip driving from Toronto to Eastern Canada, and to past the time I decided to listen to 13 hour worth of Dave Ramsey podcast. I learned about Dave Ramsey just from reading other financial blogs and forums. Dave Ramsey is a financial coach who tries to teach people how to get out of debt and start building wealth. He uses a very simple 7 steps system that every one of his audience can follow. Anyway here are his 7 baby step in the picture below.

Before starting any of these steps, it is important to ensure that you have a budget and that your monthly spending doesn't exceed your income. If you can't have a positive monthly cash flow then you'll need to either generate more cash or spend less. Spending less might mean getting a cheaper house or a cheaper car so that your monthly payment is much less.

Step 1

Pretty straight forward, it literally just means putting aside $1,000 in a normal savings account. That is it, don't need to invest it or anything.

Step 2

This step is to pay off all your debt minus excluding your mortgage using a technique call debt snowball. A very common method to build momentum while paying off debt, you can easily google "debt snowball" and learn about it.

Step 3

Once all your debt has been paid off, then you put more money into your savings account, this pile of money becomes your emergency fund. Dave's advice is to keep this fund liquid, the point is not to invest and grow this fund.

Step 4-6

Then a lot of time Dave will suggest doing these three steps simultaneously, his rule of thumb was to invest 15% pre-tax income for retirement. Then with money left over you can choose however you want to split it between saving for a short-term goal (vacation, new car, down-payment, etc.), save for kids college fund, and put extra-payment towards your house.

Step 7

Once you have your house pay off then he tells people to be generous and give to a cause that matters to them.

I love the 7 baby step because it's so simple and helps you prioritize what you need to do depending on which step you are currently at. I also like it because it separates a mortgage debt with other debt, in a way it tells people that it is okay to have a mortgage as long as that's your only debt. It definitely took the pressure off me hearing about it, before I put a lot of pressure on myself to be debt free that I was prioritizing mortgage over investment. Now I feel that I can split my money evenly between mortgage, investment, and other savings. A key thing I want to point out is that if you can't invest around 15% of your pre-tax income towards retirement then you'll need to revisit your budget and see where you can cut spending.

1/14/2019

First Net Worth Update of 2019

Happy 2019, January is goal setting months, might be a good time to start getting some good financial goal for the year. I'll share with you all my goal for 2019 in the next few weeks.

Asset

Chequing: $581

TFSA Investment: $75,408

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $122,440

*Credit Card is paid in full every month

Last Net Worth Update: $323,347

Current Net Worth: $330,549

Asset

Chequing: $581

TFSA Investment: $75,408

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $122,440

*Credit Card is paid in full every month

Last Net Worth Update: $323,347

Current Net Worth: $330,549

11/15/2018

Goal Revisited

When this blog started in April 2017 my goal were as follow:

"My short term goal is to have my mortgage paid off in 3 years (~$160 000 left). My next goal is to have a net worth of $1 million by the age of 40, and my long term goal is to generate sufficient passive income ($15,000/month)."

I have recently revisited my goal to be more bold and more daring after being inspired by reading several books. I have decided to change my medium term goal to having a net worth of $10,000,000 by age 45. I am currently 29, so this will give me 16 years to reach that goal. I do not know right now how I'll achieve this goal but I am sure I'll figure out a way.

"My short term goal is to have my mortgage paid off in 3 years (~$160 000 left). My next goal is to have a net worth of $1 million by the age of 40, and my long term goal is to generate sufficient passive income ($15,000/month)."

I have recently revisited my goal to be more bold and more daring after being inspired by reading several books. I have decided to change my medium term goal to having a net worth of $10,000,000 by age 45. I am currently 29, so this will give me 16 years to reach that goal. I do not know right now how I'll achieve this goal but I am sure I'll figure out a way.

11/12/2018

FIRE and finding your why.

Recently I have learned what the acronym FIRE means when it comes to personal finance: It stands for Financial Independence Retire Early, which is pretty much what I am trying to achieve through the goals that I have committed myself to. Some people will argue that retiring early can make life boring, but for me retiring just means that I have time to do the things that I really want to do.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

I have been reading a lot of books lately and learned that finding your why? before you start on a FIRE journey is really important. You need to figure out why you want to be financial independent before you'll be able to commit your goal. For me, my why is spending time with people that I enjoy spending time with. I also want to wake up knowing not having to every stress about money and knowing that my family is taken care of because I have enough money.

Short post today, but I encourage you to dig deep and start asking the why? Then once you have the answer, continue to ask why until the idea become so simple that it can be summarize in a few word.

11/04/2018

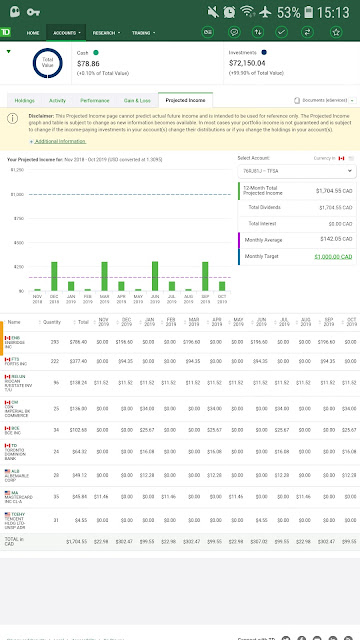

Neighbor Joe - Passive Income November 2018 - $1,704/Year

About a year ago I started to track my passive income as another way to track my progress. I like tracking passive income because it shows me an instant result of my investment. My brokerage account with TD has a very useful feature that shows the projected income for the next 12 months as shown in the screenshot below.

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

I have done some reshuffling of my stock holdings which help increased my passive income from dividends. It is now at$1,704/Year or $142.05/Month. Not a lot but it is still a tax-free passive income. What will you do with an extra $142 a month?

February 2018 - Update(1577.33/Year):

http://www.slowlybutwealthy.com/2018/02/neighbour-joe-february-2018-157733year.html

December 2017 Update($1463/Year):

http://www.slowlybutwealthy.com/2017/12/neighbor-joe-passive-income-update.html

Original Post ($1024/Year):

http://www.slowlybutwealthy.com/2017/10/neighbor-joe-passive-income-1024year.html

Neighbour Joe - November 2018 Net Worth

My apology for my disappearance in the last six months, but it has been a busy time with work and I lost focus on this blog. But now I am back and hope to be more active with my post. Here is my net worth as of today.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

Asset

Chequing: $335

TFSA Investment: $72,228

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $125,087

*Credit Card is paid in full every month

Last Net Worth Update: $310,745

Current Net Worth: $323,347 (+4%)

My net worth went up since I last posted not because of I any exceptional return from my investment. It was mostly due to aggressive mortgage payment as well as putting money from my monthly pay into my TFSA. The key is to be disciplined with your spending and aim to money aside each month towards building your wealth.

3/16/2018

Time, the ultimate currency!

Today, I am going to try to put things in a new perspective and hopefully will either motivate you to start your journey or re-motivate you to keep going. The topic is that everything about this journey is related to time.

In 2011 there was a movie call "In Time" staring Justin Timberlake, which is enough for some people to go see the movie. I watched the movie because I was drawn into the concept presented in the movie where the universal currency became the time you have left to live. There is some truth to the movie, because currency is ultimately related to time.

You spend time to build your knowledge and skills which then translate to either getting a job or running your own business. Both of those will consume more of your time but you get money in return for your time. Therefore this can be written out in a simple formula: Time x Skills/Knowledge = Money. There is an old saying that time is money, but lets flip that saying, so money is time.

In 2011 there was a movie call "In Time" staring Justin Timberlake, which is enough for some people to go see the movie. I watched the movie because I was drawn into the concept presented in the movie where the universal currency became the time you have left to live. There is some truth to the movie, because currency is ultimately related to time.

You spend time to build your knowledge and skills which then translate to either getting a job or running your own business. Both of those will consume more of your time but you get money in return for your time. Therefore this can be written out in a simple formula: Time x Skills/Knowledge = Money. There is an old saying that time is money, but lets flip that saying, so money is time.

3/01/2018

Neighbour Joe - March 2018 Net Worth

The last update for FY 17/18.

Asset

Chequing: 218.43

TFSA Investment: $62,214.83

TFSA Mutual Fund: $3,814.04 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $132,501.36

*Credit Card is paid in full every month

Asset

Chequing: 218.43

TFSA Investment: $62,214.83

TFSA Mutual Fund: $3,814.04 (Invested in TD e-series index fund)

Real Estate: $224,000 (Purchase Price of my house)

Define Benefit Work Pension (Current Transfer Value): ~$153,000 (Last checked in Jul 2017,aprox $1000 a month of contribution)

*Automobile is not included (No monthly car payment)

Liabilities

Mortgage: $132,501.36

*Credit Card is paid in full every month

Subscribe to:

Posts (Atom)